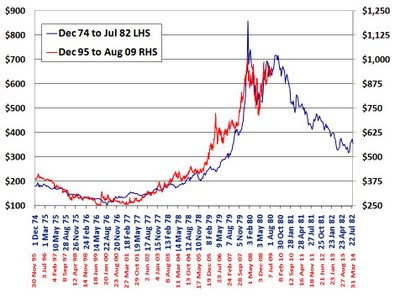

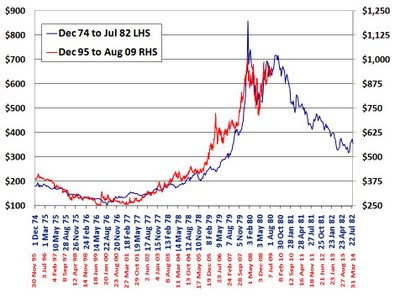

I have kept my super secret system a secret for many years, but I have to let you in on it now because a great calamity will befall gold shortly – once it breaks $1000 it will be downhill to $500. The chart below does not lie!

You will note on my chart that the time scales for the two different time periods does not match. This is because the world has gotten faster, information move quicker, therefore chart patterns are compressed. After many years of study I discovered that the world had accelerated by 40%, so that each day in the 1970s equals 1.4 days in the 1990s.

I then realised that one cannot study gold patterns until 1975, when it was no longer illegal to own gold. This allowed for human emotions to show up in prices. I then realised that the speeding up of information began in 1996, because this was the year that the Internet really began to take off. With this insight, I found this pattern and have kept it to myself to make massive profits but now the charts foretell collapse. You have been warned, get out now.

PS - As you can tell from the above that I don't put much store in reading tea leaves, sorry, charts. There is a legitimate use of them, but I think a lot of people choose timescales and see patterns just to reinforce their preconception.

You will note on my chart that the time scales for the two different time periods does not match. This is because the world has gotten faster, information move quicker, therefore chart patterns are compressed. After many years of study I discovered that the world had accelerated by 40%, so that each day in the 1970s equals 1.4 days in the 1990s.

I then realised that one cannot study gold patterns until 1975, when it was no longer illegal to own gold. This allowed for human emotions to show up in prices. I then realised that the speeding up of information began in 1996, because this was the year that the Internet really began to take off. With this insight, I found this pattern and have kept it to myself to make massive profits but now the charts foretell collapse. You have been warned, get out now.

PS - As you can tell from the above that I don't put much store in reading tea leaves, sorry, charts. There is a legitimate use of them, but I think a lot of people choose timescales and see patterns just to reinforce their preconception.

Very interesting chart....

ReplyDeleteSo you say you don't put much faith in tea laves (uhhmmm - charts) however you make the call to "get out now"

Seems like a major contradiction.

Nice work but I can tell you a few things too that have changed since the 70's that will make your chart look ,well,like a chart.We could begin with the very unit the Price of Gold is measured against and then move to.......nah...its been said by many others already.

ReplyDeleteI posted the chart at Kitco https://www.kitcomm.com/showthread.php?t=48046 and it doesn't seem many have a sense of humor.

ReplyDeleteWas going to post it up on Seeking Alpha, but thought they wouldn't get it. Kitco response is confirming my decision.

Well I can see why people don't get it. Is it a tongue-in-cheek chart or a serious analysis? I sense there is some underlying sarcasm but it seems you are hedging either way. Great outside the box thinking though and definately an interesting overlay. But imho, highly spurious.

ReplyDeleteObviously his chart is a scam or he wouldnt be slaving working for a mint making a small wage.

ReplyDeleteIt's a good match. Try inverting the more recent data, it seems to show a round cloud with underneath kite and string formation.

ReplyDeleteVery bearish I agree.

Laugh out loud funny, Bron.

ReplyDeleteDo not underestimate the appetite of the general public for gold, now that all other asset classes show negative YTD. The difference to 30 yrs ago is that we now have higher unemployment, consumers maxed out on their credit cards and a generally growing distrust of paper assets. Gold/silver have both a long way to their inflations adjusted historic highs.

ReplyDeleteOr maybe gold will just be forgotten, this time. I'd assume that bullion dealers are much rarer than they were in the 70s, and we've had two generations to which gold has been irrelevant.

ReplyDeleteBut I am your "general public", woken up by the crisis, formerly oblivious to PMs. It's only investigation of the history of money lately that lead me to this place. How many more will come, and when?

Welcome to the world of gold, goldnoob. I think there will be more of you waking up in the future, only a few of which need to decide to protect their wealth via gold to provide a support to the gold price.

ReplyDeleteCheers for the welcome Bron.

ReplyDeleteYes, I think you're right (and I remember you writing that retail is such a small part of the market that it has negligible effect on price).

Perfectly! Where have you found it?

ReplyDeleteI'v recently read not a late article about buying gold "Nothing is known against gold". (http://goldvender.com/2009/06/30/nothing-is-known-against-gold/)

What do you think about?

Bron, I'm sure you realise that not many other countries in the English speaking world, besides maybe New Zealand and Ireland, would get the Australian sense of humour, and the long tradition of larrikinism and of taking the p!ss on all sacred cows.

ReplyDeletePosting this chart on Kitco? You are cheeky for having baited our American friends like that...they wouldn't know what hit them, and would probably be quietly saying to themselves: "what the f...!"